AI transforms mortgage companies by enhancing client retention through data-driven insights and personalized engagement strategies. By analyzing behavior patterns and predicting future needs, you can effectively re-engage past clients. AI crafts tailored messages and prompts timely interventions, seamlessly addressing potential churn risks. Using AI to streamline operations enhances client satisfaction, fostering loyalty and sustainable growth. Discover how AI’s personalized outreach maintains a competitive edge in the dynamic mortgage market.

The Growing Importance of Client Retention in the Mortgage Industry

As competition in the mortgage industry intensifies, client retention is essential for maintaining a sustainable business model. You know that fostering client loyalty is more than just a buzzword—it’s a strategic necessity. Data shows that acquiring new clients is five times more costly than retaining existing ones, underscoring the importance of effective retention strategies. You can enhance client satisfaction and loyalty by focusing on personalized services and proactive communication. Implementing data-driven insights allows you to predict client needs and tailor your offerings accordingly. Innovate by leveraging technology to streamline processes and create seamless experiences. As you refine your retention strategies, remember that a loyal client base drives revenue and fosters long-term growth and stability.

Understanding AI’s Role in Enhancing Customer Engagement

When you harness the power of AI, enhancing customer engagement in the mortgage industry becomes a strategic advantage. AI’s ability to analyze vast datasets enables you to understand client behavior and preferences more precisely. This insight allows you to tailor your engagement strategies, ensuring they resonate with your clients’ needs. However, it’s vital to balance innovation with AI Ethics. Prioritizing transparent data usage builds customer trust, essential for long-term relationships. Ethically implementing AI fosters an environment where clients feel valued and understood. This trust, paired with data-driven insights, empowers you to address client concerns and anticipate their needs proactively. Ultimately, this strategic approach boosts retention and positions your company as a leader in customer-centric innovation.

Personalizing Client Communication Through AI

Leveraging AI to personalize client communication transforms how you interact with your mortgage clients. By analyzing data on client preferences, AI allows you to craft messages that resonate with individual needs and interests, enhancing engagement. AI identifies communication trends, helping you determine the best channels and times to reach clients effectively. This data-driven approach guarantees timely and relevant communications, increasing the likelihood of client retention.

AI doesn’t just automate; it adds a layer of personalization that traditional methods lack. By adapting to evolving client preferences, AI helps you maintain a competitive edge in the dynamic mortgage industry. Embracing AI in client communication means you’re not just keeping up with trends—you’re setting them, fostering deeper client relationships.

Predicting Client Needs With Advanced Analytics

Thanks to AI-powered advanced analytics, understanding your client’s future needs is no longer a guessing game. By analyzing client behavior and leveraging data trends, you can anticipate what your clients might require before they even realize it. AI examines vast datasets to uncover patterns and insights, enabling you to predict shifts in client preferences and market conditions. These predictions allow you to tailor your offerings, ensuring they align perfectly with emerging client demands.

Stay ahead of the curve by integrating these insights into your strategy. With AI, you can transform raw data into actionable intelligence, driving innovation in your services. Embrace this technology to meet and exceed client expectations, positioning your company as a leader in the mortgage industry.

Timely Solutions: How AI Optimizes Client Interaction

You’re looking for ways to enhance client interactions and AI offers data-driven solutions through predictive engagement strategies. By leveraging personalized communication channels, you guarantee that your messages resonate with each client. Additionally, AI helps you time proactive outreach perfectly, increasing your chances of retaining satisfied mortgage clients.

Predictive Engagement Strategies

While AI transforms industries, its role in mortgage client retention is particularly impactful through predictive engagement strategies. By leveraging predictive algorithms, you can anticipate client needs before they even express them, ensuring timely and relevant interactions. These algorithms analyze engagement metrics, such as previous communication patterns and transaction histories, to forecast when a client might be ready for refinancing or new mortgage opportunities. This data-driven approach enhances client satisfaction and increases retention rates by ensuring that your outreach efforts are both proactive and precisely targeted. In an industry where timing is essential, employing AI to optimize client interaction offers a competitive edge, allowing you to re-engage past clients effectively and foster long-term loyalty.

Personalized Communication Channels

Building on the power of predictive engagement strategies, personalized communication channels emerge as a pivotal component in optimizing client interaction through AI. By leveraging omnichannel strategies, mortgage companies can seamlessly integrate various communication platforms, ensuring that each client interaction is consistent and contextually relevant. This approach allows you to implement targeted messaging, tailoring communications to specific client needs and preferences. Utilizing AI, you can analyze client data, predict their needs, and deliver messages through their preferred channels—be it email, SMS, or social media. Such precision not only fosters loyalty but also enhances client satisfaction. In an era where clients seek personalized experiences, these AI-driven strategies enable you to re-engage past clients effectively, driving retention and fostering long-term relationships.

Proactive Outreach Timing

Timing is essential when aiming to enhance client interaction, and AI provides powerful tools to improve this aspect. By leveraging AI, you can deploy proactive outreach strategies that anticipate client needs and deliver communication precisely when it’s most impactful. AI analyzes vast datasets to determine ideal engagement timing, ensuring your messages aren’t just timely and relevant. This data-driven approach increases the likelihood of re-engagement, as clients receive information at moments that align with their decision-making processes. For mortgage companies, it’s not just about contacting past clients—it’s about doing so with precision. AI’s ability to fine-tune outreach timing transforms how you maintain relationships, leading to higher retention rates and a more personalized client experience that fosters loyalty and trust.

Creating Seamless Customer Experiences Using AI Technology

As mortgage lenders endeavor to enhance customer satisfaction, leveraging AI technology offers a powerful tool for creating seamless customer experiences. By mapping the customer journey, AI identifies key touchpoints where clients frequently interact. This lets mortgage companies personalize interactions and anticipate customer needs, ensuring a smoother process. Through experience mapping, AI analyzes data to uncover patterns, allowing lenders to streamline operations and reduce friction points.

Furthermore, AI-driven chatbots and virtual assistants can provide real-time assistance, guiding clients throughout their mortgage process. These tools improve efficiency and build trust by offering timely, relevant solutions. Embracing AI technology in this way enhances your ability to deliver a holistic, seamless experience that meets the evolving expectations of today’s tech-savvy clients.

Strengthening Client Relationships With Data-Driven Insights

Leveraging data-driven insights for personalized engagement strategies can enhance your client relationships. You can anticipate needs and tailor your interactions by analyzing predictive client behavior. This approach strengthens loyalty and positions you to address potential issues before they arise proactively.

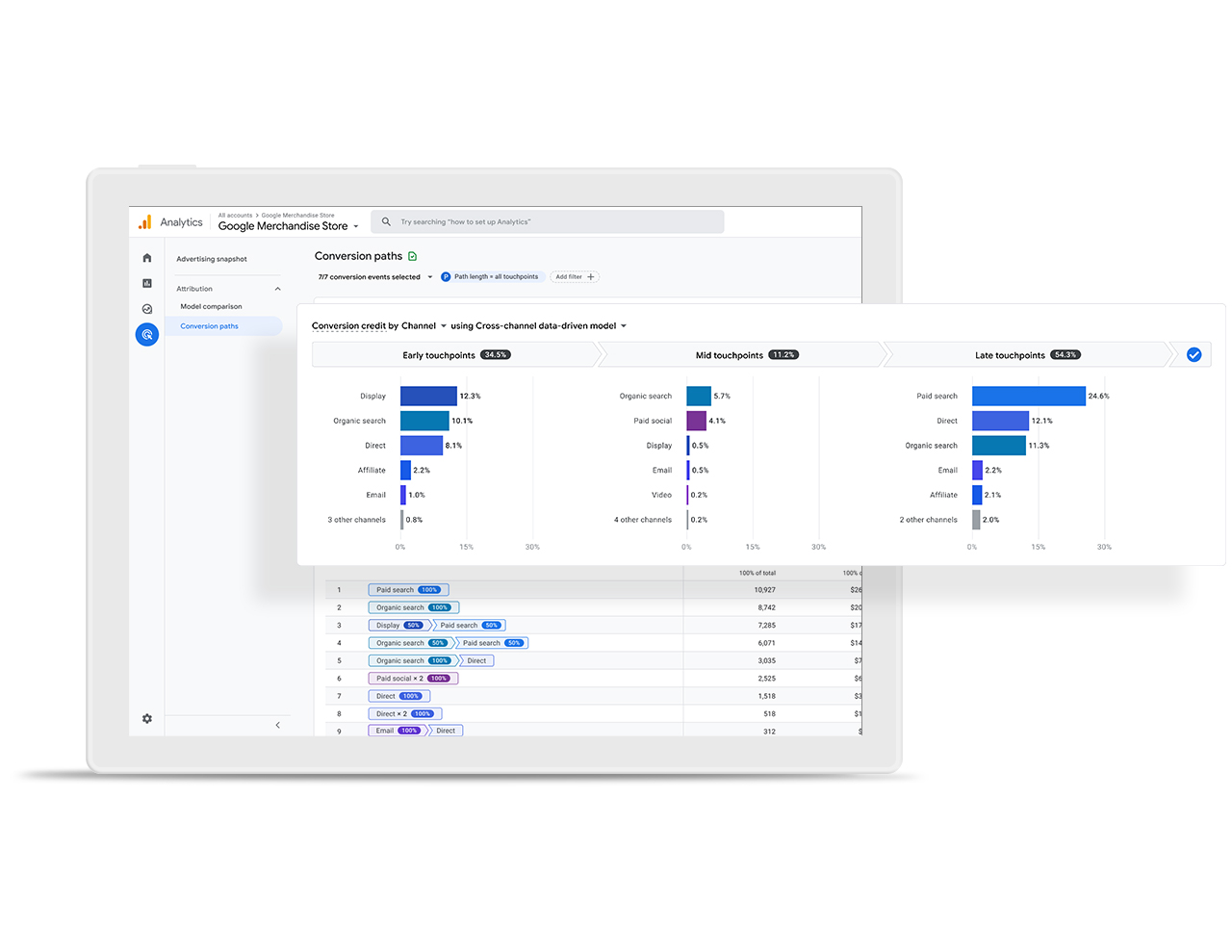

Personalized Engagement Strategies

How can data-driven insights revolutionize your approach to client retention in the mortgage industry? You can create a meaningful connection with clients by leveraging personalized engagement strategies. Understanding client feedback and analyzing engagement metrics are critical. Data-driven insights reveal patterns and preferences, enabling you to tailor interactions uniquely. Consider these strategies:

- Segment clients based on feedback to address specific needs.

- Track engagement metrics to identify which communication channels are most effective.

- Personalize content with data, ensuring relevance in every message.

- Automate responses for timely interactions, enhancing the client experience.

- Leverage AI tools to predict what your clients need before they even ask.

These strategies foster loyalty and set you apart in a competitive market, ensuring your clients feel valued and understood.

Predictive Client Behavior Analysis

Revealing the potential of predictive client behavior analysis in the mortgage industry can drastically transform your approach to client retention. By leveraging AI-driven tools, you can better understand client sentiment, allowing you to anticipate needs and tailor interactions effectively. Behavior forecasting equips you with insights into client trends and potential churn risks before they manifest. This proactive strategy strengthens client relationships and enhances your competitive edge. Imagine spotting signs of dissatisfaction early and addressing them precisely, keeping your clients engaged and loyal. In a fast-paced market, harnessing data to predict client behaviors guarantees you’re not just reacting to changes but strategically shaping your future interactions for long-term client retention and satisfaction.

The Impact of AI on Business Growth in the Mortgage Sector

Incorporating AI into the mortgage sector accelerates business growth by streamlining operations and enhancing client retention strategies. You can leverage AI adoption to stay ahead of market trends and meet evolving client expectations. Tech integration delivers competitive advantages and cost efficiency, essential for thriving in today’s dynamic environment. However, steering through regulatory challenges with innovation strategies remains critical for sustainable growth.

- AI Adoption: Aligns with market trends, offering new insights.

- Tech Integration: Enhances operational efficiency and client satisfaction.

- Client Expectations: AI tools help anticipate and fulfill needs.

- Regulatory Challenges: Guarantees compliance while fostering innovation.

- Competitive Advantage: Differentiates your services in a crowded market.

Conclusion

In the mortgage industry’s bustling marketplace, AI acts as your compass, guiding you through the labyrinth of client retention. It transforms raw data into a symphony of personalized insights, predicting needs like a crystal ball and crafting seamless experiences. By embracing AI, you’re not just keeping up; you’re leaping ahead, turning past clients into lifelong partners. With data-driven precision, AI becomes your secret weapon, fueling growth and ensuring you remain a step ahead in this competitive arena.